AssetClassic - Monterey Car Week 2024: Our take on the auctions

Monterey Car Week, held annually in August on California's picturesque Monterey Peninsula, continues to stand as the reference for the collectible car market - while being key to interpret the US market, the key messages also resonate across the Atlantic.

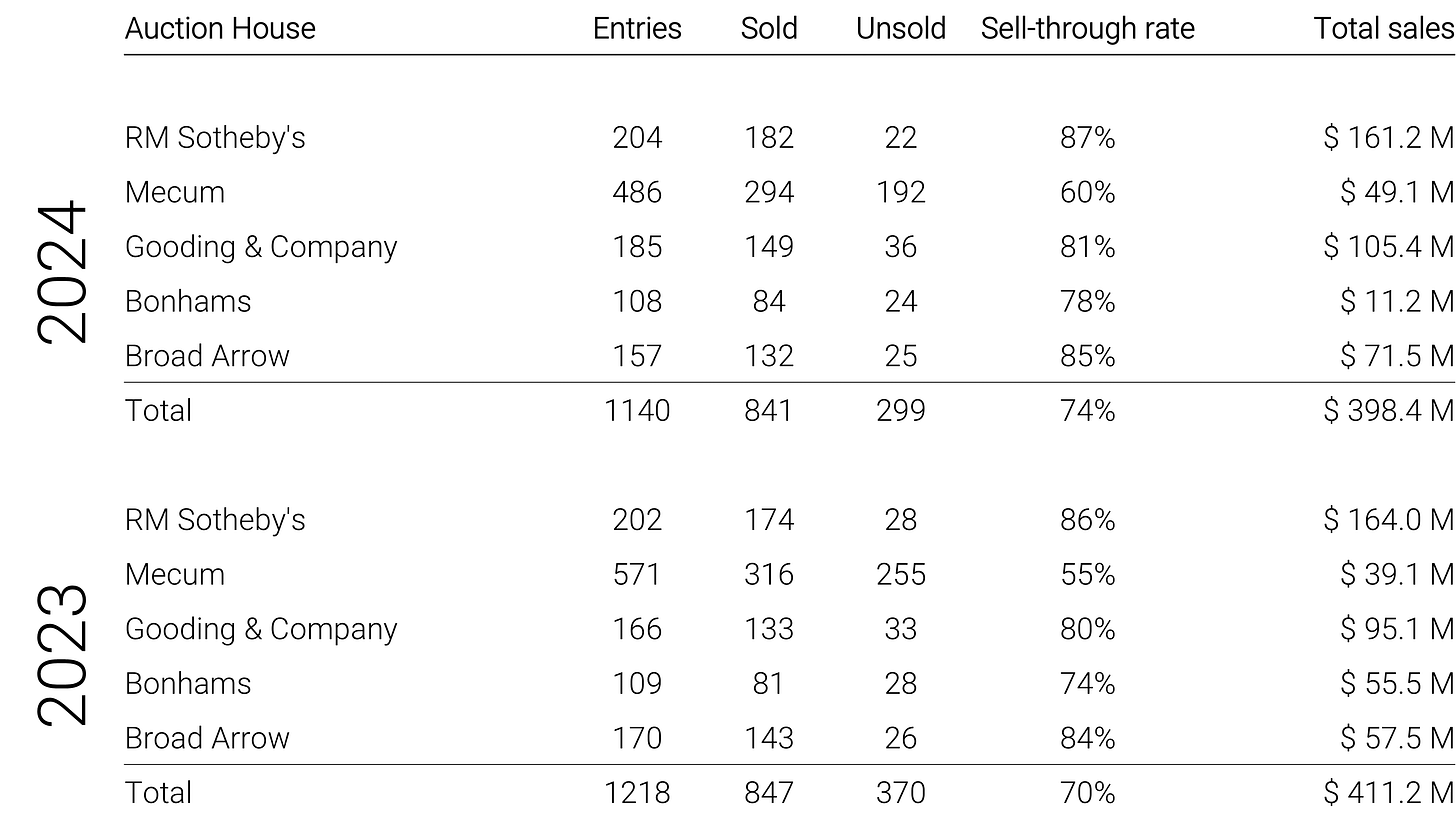

With 1,140 cars crossing the auction block across four days, this event served once again as a barometer for assessing market trends, evolving collector tastes, and strategic investment opportunities.

The headline figures: Solid performance amidst shifting dynamics

This year, five major auction houses (RM Sotheby’s, Gooding & Company, Bonhams, Mecum and Broad Arrow) brought an impressive lineup of vehicles to Monterey, with 840 of the 1,140 vehicles finding new owners, resulting in a solid sell-through rate of 74%.

There was, as usual, a significant number of no-reserve lots - Mecum, with its 60% sell-through rate, being the outlier and indicator of what could otherwise have been.

Post-auction sales are ongoing, potentially improving these statistics in the weeks following the event.

Among the auction houses, RM Sotheby’s led the charge with $160 million in sales (roughly comparable to last year’s result, and surely aided by the sale of the Ferrari 250 SWB California - more on that below), followed by Gooding & Company with over $105 million.

Compared to other years - such as, most recently, 2022 - it was more the volume of cars in the $200k - 2M range that brought to the overall performance rather than a few top hitters (many of which went unsold, or were sold after the auction).

Market signals: Ferrari’s unusual downshift?

One of the most notable trends observed during this year’s Monterey Car Week was the surprising underperformance of Ferrari models from the 1950s and 1960s - a segment historically considered a “safe bet” for collectors and investors alike. At AssetClassic, our proprietary AssetClassic Data algorithms had already flagged potential softness in this sector, leading us to adopt a cautious approach and refrain from a few purchases we had considered until Monterey would prove what data was telling us.

This was probably the usual example of short term speculation seldom being a wise move - compared to more oculate, data-driven investments. For instance, out of the four Ferrari 365 GTS/4 Daytona Spiders offered, probably on the back of the hype from the hugely successful sales by RM at Munich and Monaco over the last 12 months, only one sold at auction, fetching 30% less than the previous sales. Another relative shocker were the two F40s going for way less than the average two years ago - one being the charming “Minty” we all had the pleasure of seeing at the main events around the globe over the last two years. Non original color, accidents in its past… But still it deserved more than $1.8 M all in. As always, we remain confident that a well-maintained Ferrari will continue to be a valuable investment, but as every wise investor will tell you… Past performance isn’t a predictor of future returns, and it’s key to read every nuance of the market.

Strategic focus: Mid-range vehicles and diversification

A key takeaway from this year’s event, as mentioned above, is the relative strength of vehicles priced between $200,000 and $2 million - the core range for AssetClassic. The market's gravitation towards these mid-range vehicles suggests a strategic shift among investors, who appear increasingly wary of placing all their capital into a single high-value asset. This diversification strategy not only spreads risk but also reflects a broader trend towards liquidity, with buyers favoring assets that can be more easily traded in the future.

The mileage obsession: An unfortunate trend

Another trend that continues to dominate the market is the obsession with low-mileage vehicles. At AssetClassic, while we recognize the market’s preference for these “time capsule” cars, we maintain that cars - and especially those with a lot of character - were meant to be driven and enjoyed. The market’s inclination to excessively reward cars that have seen little to no use can be in our opinion detrimental to the long-term passion and preservation of the hobby. Nevertheless, as market professionals, we observe and adapt to these trends, ensuring that our portfolio is aligned with current preferences while keeping an eye on potential future shifts.

Age counts: But it’s a trend, not a rule

Many believe only youngtimers perform these days. While of course, as AssetClassic Data shown at The Classics Forum and in our recent post here on Substack highlighted, cars from recent decades have performed better, there still are notable exceptions. Several stunning cars from the 1930s - 1960s (the reviled period) sold very well this year, including RM Sotheby’s top seller, the Ferrari 250 California SWB, which fetched over $17M, and Gooding’s 1938 Alfa Romeo 8C 2900B Lungo Spider, sold for over $14M - beating the pure demographics argument. We doubt many bidders were 18 when the car was built and wish they had driven it on their first trip.

Though youngtimers might be easier to sell in the current market, there's always a buyer for high-quality cars.

The online era: You can’t ignore online bidding

Monterey Car Week 2024 also underscored the growing importance of online bidding. RM Sotheby’s, which embraced this trend, saw improved results, further validating the significance of digital channels in today’s market. While some auction houses still prioritize in-person bidding, the reality is that serious buyers can be anywhere, and a robust online bidding platform is no longer a luxury but a necessity. And even RM Sotheby’s had a glitch lasting a few minutes - and a few lots - which didn’t allow online bidding. An example of what this can cause? A beautiful 1972 BMW 3.0 CSL going for way less than it deserved (and than we probably would have bid). We live in a digital era, even a traditional sector like ours can’t ignore it.

Conclusion: Even when the market is considered complex, it’s still more resilient than any other

Monterey Car Week remains the most relevant event for understanding the classic car market, offering invaluable insights into buyer behavior, market dynamics, and investment strategies. As much as we dive deep into the data to understand microtrends - one thing is clear: even in a market environment regarded by many as soft, you have thousands of people willing to buy almost half a billion worth of cars in four days - a figure comparable to previous years, with some great results, and no crash. As always, we aren’t aware of any other asset class which offers the same reliability.

Picture: RM Sotheby’s