AssetClassic Auction Index - H1 2024 performance

We’re proud to introduce our new AssetClassic Auction Index - tracking the performance of the broader auction market for classic and collectible cars.

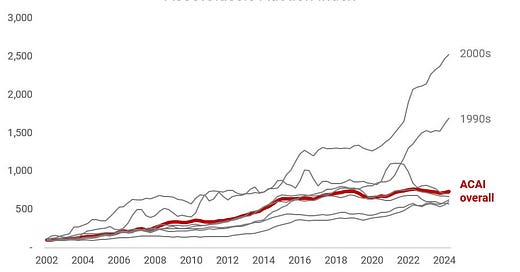

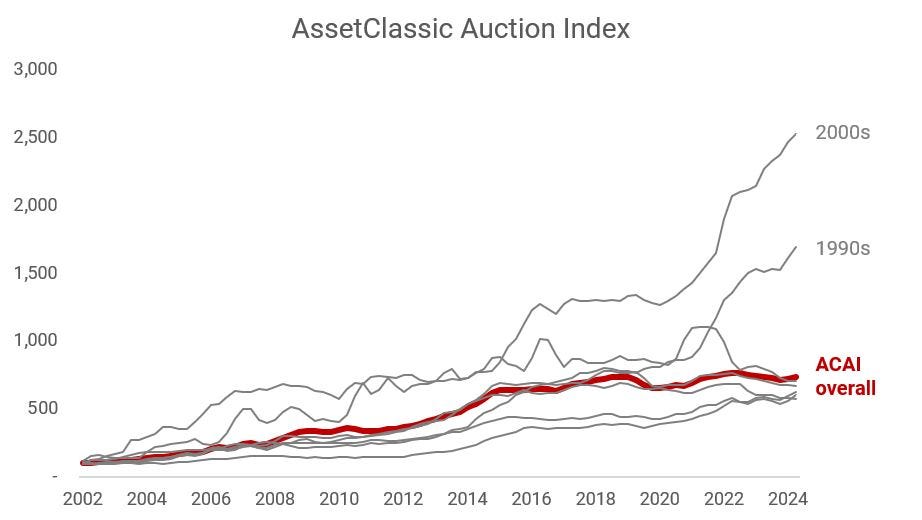

The AssetClassic Auction Index (ACAI) is based on >500,000 auction transactions representing >90% of the auction market value. It is composed of >3,000 distinct models across >200 makes. Each model's contribution to the index is based on its auction market liquidity, making the overall index representative of a typical/average portfolio.

The ACAI includes classic and collector vehicles made before ~2010s, with a focus on those with average values >20k EUR. While our data goes back to 1970s, we have started the index in Jan 2002 at 100. The ACAI is updated monthly and based solely on auction results, with no manual adjustments or tweaks.

The full methodology will soon be shared with our Substack newsletter subscribers.

So - how is the market doing in the first half of 2024?

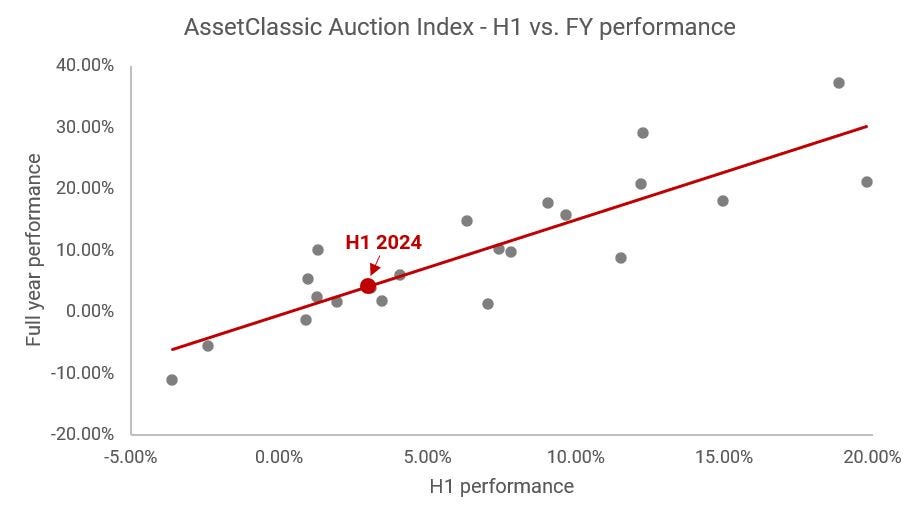

◾ Overall sector relatively flat: 3.0% gain, beating inflation and bonds but not keeping up with investor allocation in stocks or gold

◾ This is half compared to historic average H1 gain of 6.6% over last 22 years

◾ Market for cars from more recent decades (1970s-2000s) continue doing better than average (led by 1970s and 1990s with 12.9% and 11.1% H1 2024 performance respectively)

◾ Looking forward, we expect to see continued positive performance in H2 as H1 has typically been a strong predictor of YE performance and the buoyant stock market will help drive values up

◾ As every year, auctions held during Monterey Car Week 2024 next month will leave their strong mark on the market - we are very much looking forward to those