From Passion to Asset Class: Framing the Collectible Car Sector

The global collectible car market has grown into an ecosystem with €80 billion revenue. Here’s how history, culture, and finance have converged to create one of today’s most compelling asset classes.

Introduction

The collectible car market has become a fully-fledged cultural and financial ecosystem representing an intersection of heritage, investment, and experience. Earlier this year, McKinsey & Company published a study on how collectible cars had grown from “niche market to growth and innovation engine” (McKinsey, 2025), based on AssetClassic market data. That analysis was a watershed moment: it signaled to the broader investment and business community that classic cars were not merely beautiful objects of desire, but also an asset class with scale, liquidity, and global relevance.

This article is a continuation of that conversation, informed by AssetClassic’s research and discussions at The Classics Forum 2025, held at Goodwood House during the Goodwood Revival (www.theclassicsforum.com). The Forum convened more than 150 leaders from across the automotive, investment, and luxury ecosystems to debate the sector’s future. What follows is an overview of the collectible car sector as we see it today: its history, the forces shaping it, its economic footprint, and its value chain. This framing sets the stage for a series of deep dives into the sector’s individual components.

From Niche Passion to Global Asset Class

The collectible car market has traveled a long road over the past six decades. Its story can be told as a journey from fringe enthusiasm to mainstream cultural and financial relevance.

1960s–1970s: Passion without markets

In this era, collecting was a narrow pursuit. Retired race cars were often discarded when no longer competitive. Road cars, weighed down by maintenance costs, were left to rust or sold cheaply. The notion of cars as collectible assets was embryonic at best.1980s–1990s: Collecting comes of age

The seeds of the modern market were planted. Nostalgia, coupled with rising prosperity, gave birth to a restoration boom. Cars once dismissed as outdated were painstakingly brought back to life. But this period also saw the opportunistic rise of replicas and forgeries, which complicated trust and valuation. We also witnessed the first price bubble in Ferraris driven by demand from Japan.2000s–2010s: Classics as prestige objects

A new dynamic emerged. Global events such as Pebble Beach, Villa d’Este, and Goodwood Revival elevated classics into cultural icons. Online forums and media platforms created vibrant communities. Valuations surged, and carmakers themselves began to pay homage to their heritage, with retro-inspired models and design language that drew directly from their archives.2020s: Cultural and financial integration

Today, classics are “style beacons,” celebrated not just as mechanical achievements but as cultural capital. They have surpassed watches and wine to join fine art in the pantheon of alternative investments. At the same time, they serve as sustainable and authentic alternatives for leisure in an age of digital abundance and environmental scrutiny.

Macro Forces

As the sector has grown in size and prominence, it’s development has also become increasingly intertwined with broader economic and cultural shifts. Several macro trends provide context for the latest evolution:

Alternative assets in uncertain times. With traditional markets experiencing volatility, investors are diversifying into passion assets. Collectible cars, with their track record of appreciation and relative liquidity, have gained credibility as a hedge.

Cultural embrace of heritage. Fashion, music, and design all display a renewed reverence for history. Classic cars sit squarely within this movement, embodying authenticity, craft, and continuity.

Demographics and wealth creation. The population of ultra-high-net-worth individuals (UHNWIs, with $30 million+ net worth) is expected to grow from 400,000 in 2023 to nearly 600,000 by 2028 (according to latest reports by Wealth-X and Knight Frank). More than 30% already own collectible cars, and more than 35% plan to increase their holdings. This demographic underpins demand across the sector.

Technology and AI. Far from being anachronistic, the sector is embracing digital transformation. AI is entering valuation models, digital twins are reshaping restoration and provenance, and community platforms are redefining engagement. What was once purely analog is becoming data-rich and tech-enabled.

“With €800 billion in assets, €45 billion trading annually and over €40 in annual service revenue, collectible cars are no longer a niche pursuit. They are a liquid, global asset class.”

The Economic Footprint and Its Value Chain

The scale of the collectible car sector is striking. Globally, it represents approximately €800 billion in assets, with an annual revenue pool of €80-90 billion. This turnover is unusually high for passion assets: around 5% of cars change hands every year, creating a liquid market for such high-value goods.

For clarity, our analysis defines a collectible car as any vehicle at least five years out of production and valued at €20,000 or above. This encompasses both historic classics and so-called “instant classics” whose desirability and scarcity propel them into collector territory shortly after release.

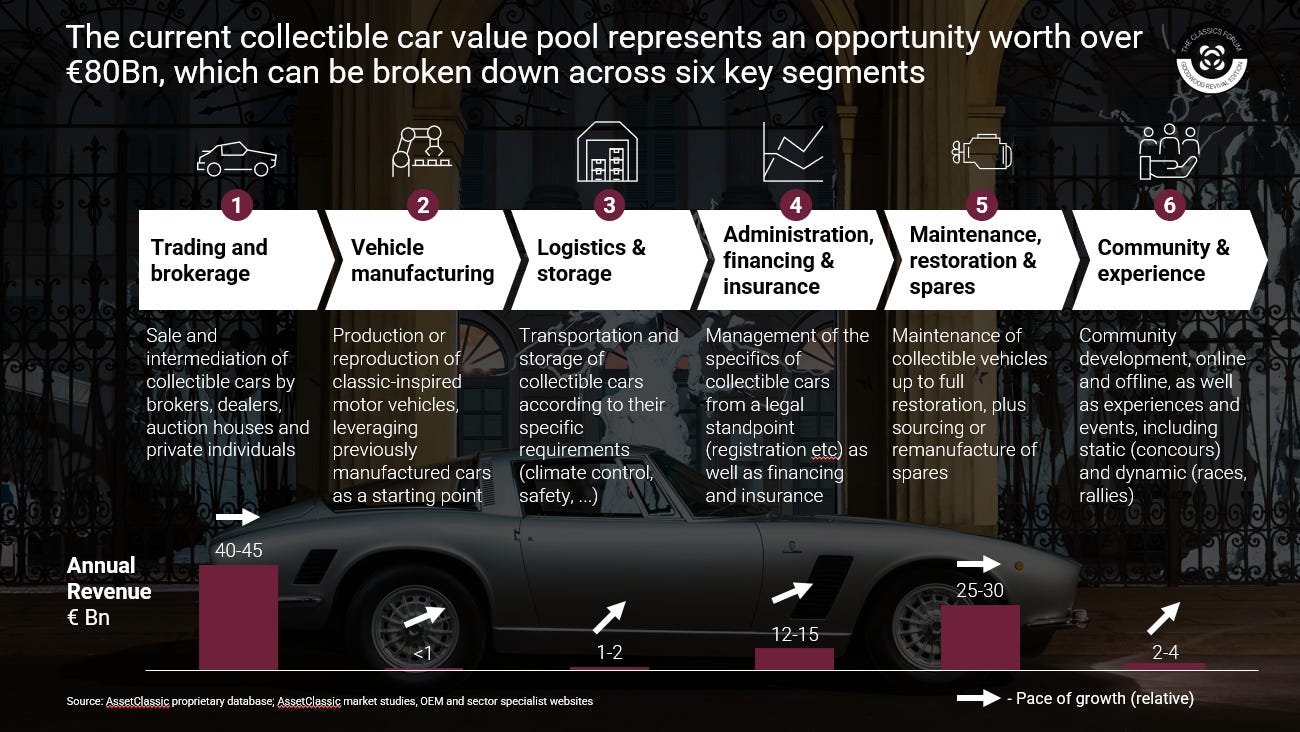

To make sense of the industry’s breadth, we map it into six value chain segments. Each represents a distinct business ecosystem with its own stakeholders, revenue pools, and innovation opportunities.

Trading & Brokerage. The beating heart of the market: dealers, brokers, auction houses, and private transactions drive liquidity and price discovery.

Vehicle Manufacturing. From restomods to continuation cars, this segment blends heritage with innovation, often reimagining classics for modern use.

Logistics & Storage. Secure, climate-controlled storage and specialist transport safeguard cars’ value and condition.

Administration, Financing & Insurance. Complex regulatory and financial needs demand specialist services.

Maintenance, Restoration & Spares. Ranging from routine upkeep to concours-level restorations, supported by a growing industry for remanufactured parts.

Community & Experience. Events, clubs, rallies, and digital communities create the cultural backbone of the sector.

The collectible car world is not a single market but rather a network of interdependent steps. Each one is highly fragmented, with many small independent operators. This fragmentation creates inefficiencies, but also space for consolidation, professionalization, and new entrants.

Lessons from Other Luxury Sectors

The trajectory of collectible cars mirrors developments in adjacent industries:

Luxury goods. The modern luxury consumer seeks authenticity, heritage, and self-expression. Classic cars deliver on all three, aligning the sector with the values driving growth in fashion and jewelry.

Fine art. Like cars, art straddles culture and commerce. The rise of professional auction houses and valuation databases shows how institutions can add transparency and liquidity.

Pre-owned watches. Once dominated by small-scale resellers, the secondary market is now the fastest-growing segment of the watch industry. Digital platforms have transformed trust and transparency, setting a precedent for cars.

These parallels suggest that collectible cars are following a well-established pattern: from niche to mainstream, and from fragmented to institutionalized.

Opportunities for the Future

Looking ahead, the sector’s potential rests on several pillars:

Professionalization. As standards for valuation, certification, and provenance mature, barriers to entry for new investors will fall.

Financial innovation. Fractional ownership, funds, and securitized vehicles could broaden access, though they require robust governance.

Customer-centric solutions. Pain points such as opaque pricing, complex administration, and fragmented logistics are ripe for innovation.

Cultural expansion. Events and communities are no longer peripheral—they are central to the value proposition, offering lifestyle, identity, and connection.

Sustainability. As sustainable fuels grow in availability, bringing them to racetracks and collectors will represent a significant opporununity to allow collectors to enjoy their vehicles in an even more sustainable way.

At the core of all these opportunities is demand. The expanding UHNWI base ensures a steady stream of new participants, while cultural and technological trends are making the sector more accessible and visible.

Want to see more? Subscribe for free to receive the next installment in this series and future sector insight.

Top of Form

Subscribe

Bottom of Form

Conclusion

The collectible car market has matured into an €800 billion global asset class, supported by a diverse value chain and shaped by powerful macro trends. It is simultaneously a cultural phenomenon, an investment market, and a lifestyle ecosystem.

The schematic of the value chain is more than an illustration: it is the map for this series. In the coming articles, we will explore each of the six segments in detail—starting with Trading & Brokerage, the arena where liquidity, transparency, and trust are tested daily.

For AssetClassic, and for those who joined us at The Classics Forum 2025, the opportunity is clear: the sector stands at the threshold of further growth, innovation, and professionalization. The journey ahead will define how collectible cars evolve from passion to permanence in the global cultural and financial landscape.

This article is part of an AssetClassic series based on insights shared at The Classics Forum 2025. Over the coming weeks, we’ll explore each part of the collectible car sector’s value chain in more detail.

Neat write up.